CAPTONTM AI

AI-powered enterprise software applications

NPL Early Warning System (EWS)

NPL Early Warning System (EWS)

Intelligent Credit Scoring (ICS)

Intelligent Credit Scoring (ICS)

Intelligent Sales Hyper-Automation(ISHA)

Intelligent Sales Hyper-Automation(ISHA)

Open Architecture

Open Architecture

Secure Deployment

Secure Deployment

NPL Early Warning System (EWS)

NPL Early Warning System (EWS)

Intelligent Credit Scoring (ICS)

Intelligent Credit Scoring (ICS)

Intelligent Sales Hyper-Automation(ISHA)

Intelligent Sales Hyper-Automation(ISHA)

Open Architecture

Open Architecture

Secure Deployment

Secure Deployment

PREDICT NPL with

up to 99% accuracy

REDUCE Non Performing

Loans by 30-50%

NEW LOAN DECISIONS

in 60 seconds

DEPLOY ML Models

75% faster

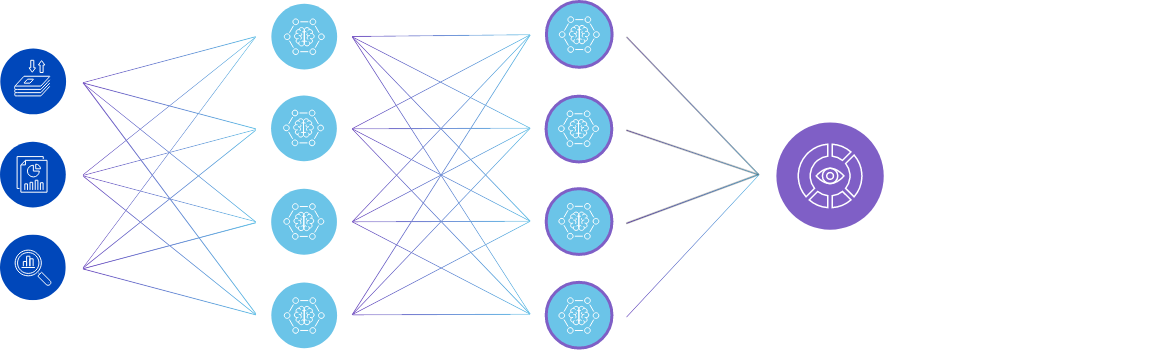

Capton™ AI is a portfolio of AI-powered, enterprise software products that enable Banking & Financial Services companies to Increase Profitability, Reduce Risks & Optimize Customer Experiences by utilizing AI/Machine learning & Behavioral Analytics. Proven AI Technology can provide strong competitive differentiation. Sophisticated ML models can be applied to massive datasets to create better output. Continuously self-learning models can be explained - providing “Explainable AI”.

NPL EWS (Early Warning System) is an enterprise software application that enables sophisticated prediction of Non-Performing Loans, by applying AI/Machine Learning and Behavioral Analytics to a combination of core banking data and dynamic external data. EWS provides role-based access to an Intuitive User Interface allowing insights into NPL default probabilities at global, regional and branch levels. A secure deployment model provides choice of on-premise, private cloud or hybrid options.

Leverages over 160 data points for prediction modeling

Predicts NPL with up to 99% accuracy in predictions (depending on datasets)

Enables Rapid training across multiple risk models.

Forecasts from 3,6,9, up to 12 month horizons

Intelligent Credit Scoring (ICS) is an enterprise software application that improves Loan Decisioning in terms of both speed and quality. ICS rapidly provides AI-based scoring of prospects with a “Capton Credit Score”. In addition to traditional approaches (like FICO scoring in the U.S.) it utilizes multiple data points for external scoring. For example, Social media scoring (LinkedIn, Facebook) can be combined with Message-based scoring (SMS/docs). Where permitted, transactional data scoring can refine this overall lending risk score.

Enables Loan decisioning in 30-60 seconds

Provides a “CAPTON” score of creditworthiness

Utilizes 25+ external scoring data points

Helps decrease Lending risk

Intelligent Sales Hyper-Automation (ISHA) is an enterprise software application that enables AI-powered intelligent hyper-automation of banks sales processes. It provides sophisticated recommendation engines, seamless integration with sales and communication tools, and hyper-personalized blending of target offers and target buyers. It combines ML/deep learning with customer knowledge to provide intelligent insights into a customer propensity for a particular product. IT provides real-time up-to-date information as to where they are in their buyer journey.

Recommends ‘right-fit’ targeted product offerings

ENHANCES customers buying experience

Automates sales workflow and outcomes

INTEGRATES with communication tools

utilizing AI/ML/Neural networks resulting in increasing accuracy of NPL predictions, Credit scoring

for retail and commercial loans, dynamic time horizons, regional characteristics and comparisons of industries and individual branches.

for regulatory compliance with on-premise, hybrid and private cloud implementation

with Interactive Dashboard with Role-based access and Hierarchical Views across regions, industries

for seamless Integration with existing/preferred software tools and processes

They wanted to improve their strategy around Loans, Non-performing loans, provisioning, high charge-offs and reduce NPL ratios that had been ranging from 7% to 11%. With Capton AI NPL EWS, they can predict that an asset could potentially turn into a non-performing loan with high accuracy and extended forecast horizon, this enabled them to take corrective measures and proactively minimize the risk of an NPL.

99.2% average prediction accuracy

$640M+ savings

27% fewer NPL

3,6,9, 12 month forecasts

They wanted to understand the risk profile of their prospects in more detail especially for first-time borrowers. They wanted to improve their underwriting processes with due-diligence in checking credit worthiness while going beyond existing standard procedures. With Capton AI ICS, they can now reach a larger community and more rapidly lend while maintaining low risk.

100% SME customer loans with Capton

6M under-served

SMEs reached

NEW LOAN

enquiries > 6 M

ONGOING

Continuous Scoring

Leave your information to schedule a demo with our team.

Stay up to date on the latest in AI for Banking by signing up to receive product and blog updates from the Capton team.